General Overview and Facts and Figures

In France, as in many of its neighbors in Europe, a series of movement restrictions during the COVID-19 pandemic made 2020 undoubtedly the year of eCommerce. But, as 2021 saw the easing and then strengthening again of restrictions, a more nuanced picture has begun to emerge of the lasting impacts on consumer shopping behaviors.

As we’ll see in this report, which is based on data from ACI and produced in association with The Paypers, the volume and value of eCommerce transactions in 2021 clearly show the release of pent-up demand from consumers hankering for a return to ‘normal’ life.

But the data also shows that some changes in behavior enforced by lockdowns look set to endure, blending with pre-COVID behaviors to accelerate adoption of experiences that blur the lines between eCommerce and bricks and mortar, such as Buy Online, Pick-up In Store (BOPIS) and Buy Online, Return In Store (BORIS).

This eBook is your snapshot of the insights that matter most when measuring the size and type of opportunities in the eCommerce market in France.

Read on to discover the trends that are here to stay, the sector-by-sector impact as lockdowns ended and were reintroduced and insights into market readiness for vCommerce, crypto payments and the introduction of Central Bank Digital Currencies (CBDC).

2 / 24

Total Population

67.6 million

Internet Penetration (internet users % of total population)

83.8

Internet Banking Penetration (% aged 16+)

73.0

Age Breakdown

| 0-14 | 15-64 | 65 and above | |

| 2015 | 18.6% | 63.0% | 18.4% |

| 2025 | 17.1% | 60.7% | 22.2% |

Banked Population

(% aged 15+)

94.8

Mobile Penetration

(per 100 persons)

109.2

Smartphone Penetration by Age Group

| 12-17 | 18-24 | 25-39 | 40-59 | 60-69 | 70+ |

| 91% | 95% | 95% | 87% | 78% | 59% |

By 2020, 50% of French online shoppers had made at least one cross-border purchase:

| to China | to Germany | to UK |

| 44% | 13% | 13% |

| % of cross-border purchases | ||

eCommerce Value

![]()

2021: EUR 122.7 billion

![]()

12%

Decreased volume of

eCommerce transactions,

2021 vs 2020

![]()

26%

Increase in average

ticket value (ATV)

![]()

74%

Of French consumers have purchased at least one product

online in the past 12 months, and they most frequently

use smartphone devices for doing so

3 / 24

Transaction Volumes are Down but ATV is Up – Way Up

The decrease in eCommerce transaction volume and increase in Average Transaction Value (ATV) appear linked. The drop off in volume was likely influenced by the return to in-store purchasing following the relaxing of COVID restrictions. But as restrictions on travel also eased, consumers flocked to the Travel & Ticketing sector to make higher value purchases. Indeed, overall the value of transactions increased 18% in 2021 compared to 2020.

By comparing the first and second half of 2021 we see a more detailed picture of the impact of COVID restrictions. As measures were eased in H1 2021 the year-on-year decrease in eCommerce transaction volumes was 16%, while ATV leapt 48% ($42). Then, as the Omicron variant emerged in H2 2021, transaction volumes and ATV moved nearer to 2020 levels (down just 6% and 8% respectively).

4 / 24

French Consumers Increasingly Favor a Blend of Digital and Physical

High growth in channels and delivery methods such as BOPIS (transactions and ATV grew 204% and 77% respectively) point to a consumer base increasingly confident with COVID-related adaptations from merchants. The growth in BOPIS also illustrates the way consumers are increasingly open to experiences that offer the best of both digital and physical shopping.

Competition remains generally very high among online platforms and marketplaces in France, and from 2018 to 2020 the market volume of the top 500 French online stores increased by 46%.

But shoppers are looking further afield, too. By 2020, 50% of French online shoppers had made at least one cross-border purchase. China accounted for 44% of those purchases followed by Germany (13%) and the UK (13%), with the latter two benefiting from the fast delivery that comes from having a solid eCommerce infrastructure.

Special mention: Mobile

The significant acceleration in digital transformation experienced in recent years has seen consumers become markedly more comfortable ordering via mobile. In line with the general picture, transaction volumes dropped by 30%, but ATV was up 45% ($33).

5 / 24

Travel, Telco and Gift Cards Post Big Gains in Transaction Volume

In general, ‘fashion’ is France’s most successful eCommerce category based on net sales, followed by ‘electronics & media’ and ‘toys, hobby & DIY’.

But the ongoing recovery from the COVID pandemic actually paints a more nuanced picture for market observers to consider.

There is an increased interest in travel and events, a sector that saw a 47% uplift in transactions for Ticketing, as consumers looked to re-embrace their pre-pandemic lifestyles. Meanwhile, although travelling within France experienced a 22% drop, there was a near two-fold (178%) uplift in French payment cards being used abroad and foreign cards used in France. This appears to further confirm the assertion that travel increased significantly in 2021 compared to 2020.

Other sectors that experienced notable year-on-year increases in transaction volumes and ATVs in 2021 included:

- Telco, where volume was up 32% and ATV 36% ($43). (Fraud attempts were also up 9%, potentially driven by the significant increase in volume and basket size).

- Retail saw a 29% increase in volume, and a $24 increase in ATV.

- Gift cards experienced a 6% increase in transaction volume and an ATV increase of 16% ($25). This is a clear indication that consumer attitudes towards traditional gifting conventions are changing, something that merchants with higher value or bulkier goods can look to take advantage of.

6 / 24

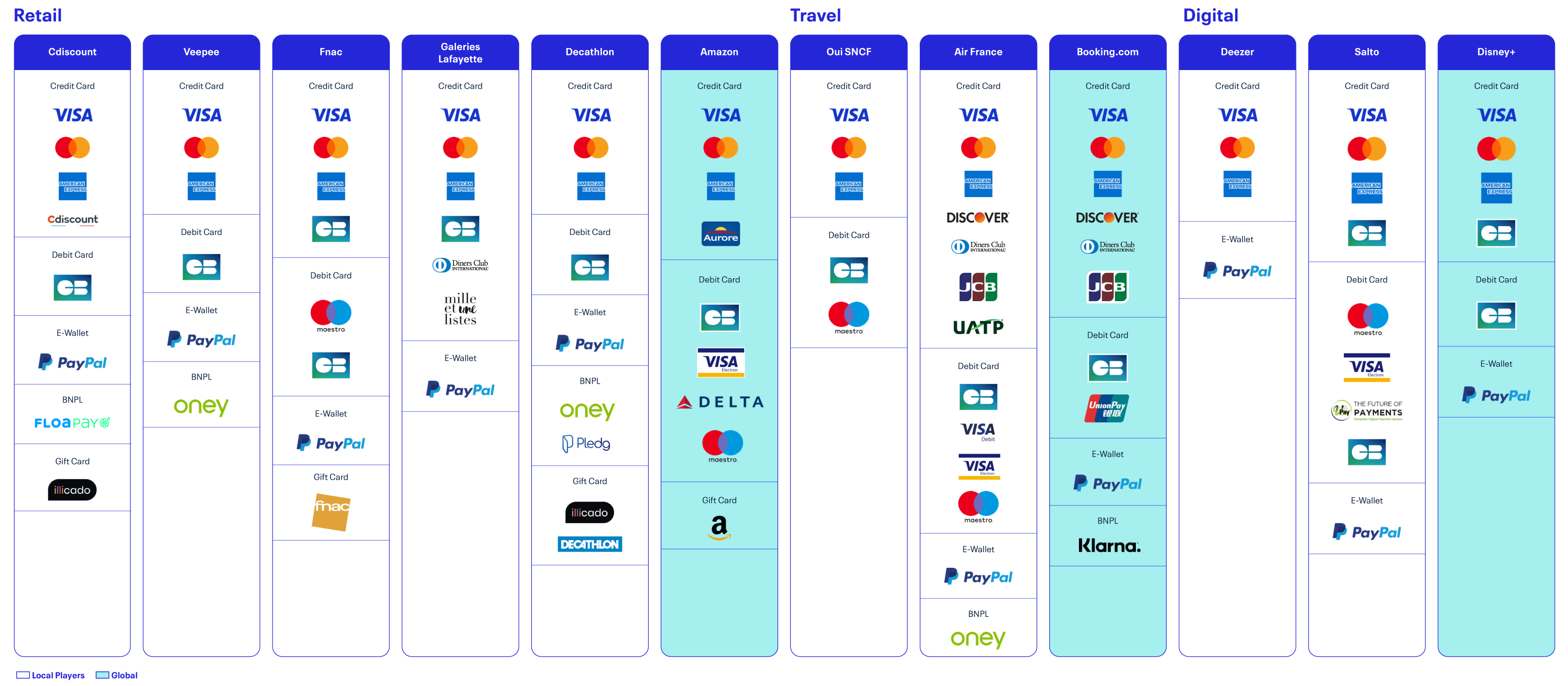

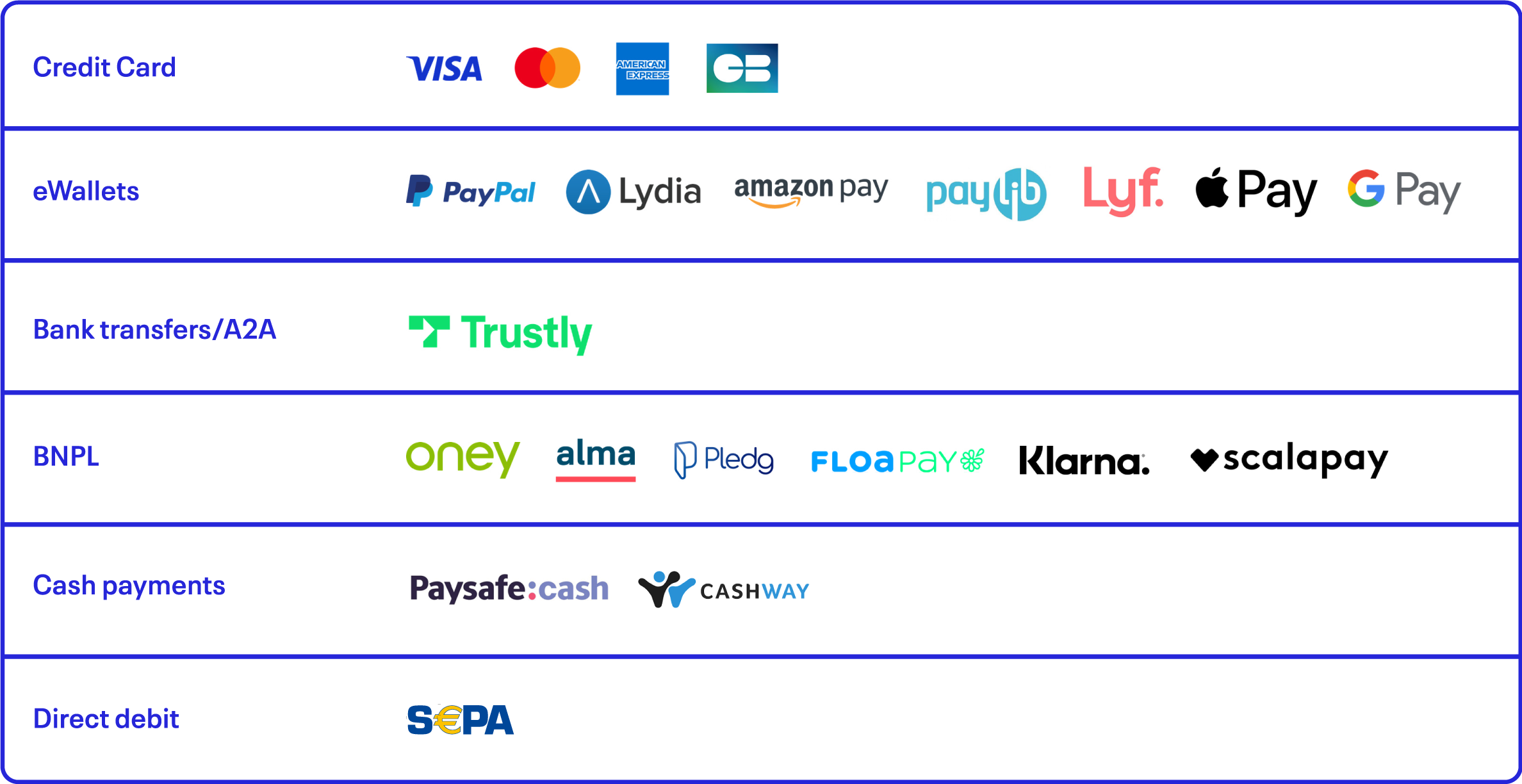

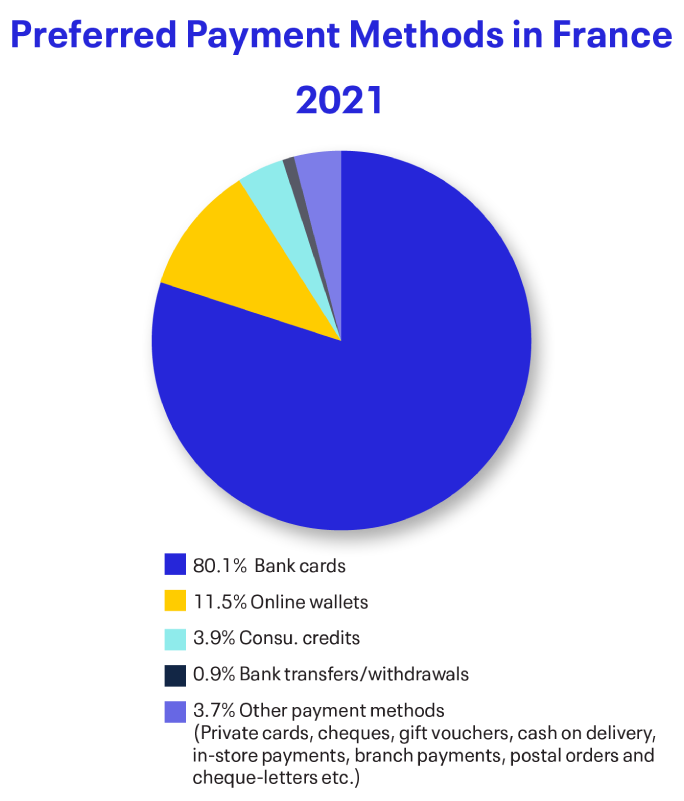

Card Remains King – but eWallets Gain Ground

Source: Key figures e-commerce 2021 Report, Fédération e-commerce et vente à distance (FEVAD)

Card remains king of eCommerce in France, with local card network Cartes Bancaires (CB) the dominant player (more than 95% of CB cards are co-branded with Visa or Mastercard).

But, as French consumers’ shopping habits have shifted online, the convenience factor of eWallets has proved too strong to resist. The eWallet landscape is made up of a mix of local players such as PayLib, Lydia, Lyf, and global brands like PayPal, Apple Pay, Google Pay, and Amazon Pay (volumes remained largely flat for physical credit and debit card transactions).

Elsewhere in alternative payment methods, Buy Now, Pay Later (BNPL) is another big winner of recent years. According to Oney, in 2019, 19% of French people paid in instalments at least once a month. By 2021, 32% reported preferring to have the option of paying in instalments more often in the future. Significant players here include offerings from local banks such as 3x 4x Oney, Floa; local startups like Alma, Pledg; global payers such as Klarna, Scalapay.

8 / 24

Popular Retailers – Return Policy and Fees for French Consumers

Name

Return Policy

Timeline

Return Cost (responsibility)

| Cdiscount | Veepee | Fnac | Galeries Lafayette | Decathlon | Amazon |

|---|---|---|---|---|---|

| 14 days | 14 days | 14 days | 30 days | 30 days or 365 days with membership card | 30 days |

| Consumers pay mailing fee | Consumers pay mailing fee | Consumers pay mailing fee | Free for consumers in France and EU | Free for consumers in the first 14 days | Consumers pay mailing fee (free for Shoes, Bags, and Clothing categories) |

Popular local brands

Global brand that is also popular in France

10 / 24

Logistics, Refunds and Return Policies

Like many other countries, France imposed a series of movement restrictions during the COVID-19 pandemic, determining French consumers to start shopping online more often. One of the main features of online shopping in France is the popularity of the ‘click and collect’ delivery method, as customers can pick up their ordered products via drive-through locations, local branches, or dedicated lockers.

EU rules govern refunds and return policies for French eCommerce merchants. These stipulate that traders must repair, replace, reduce the price, or offer a refund to customers if the goods bought turn out to be faulty or do not look or work as advertised.

Additionally, if one buys a product or a service online or outside of a shop (by telephone, mail order, and so on), they have the right to cancel and return the order within 14 days, for any reason and without providing a justification (exemptions include products such as perishable goods and drinks, personalized items, and digital goods).

Across the EU, traders must provide a refund (including shipping) within 14 days of receiving a shopper’s cancellation request, but they can delay the process if they haven’t received the goods or evidence that they have been returned.

11 / 24

eCommerce at the Cutting Edge: Social Commerce, vCommerce, Crypto and CBDCs

The social commerce opportunity

In 2025, the global social commerce industry is expected to be worth $1.2 trillion, up from an estimated $492 billion in 2021.

French eCommerce merchants have for the large part been quick to adapt to the social commerce opportunity, with about 41% having already optimized their businesses to accept payments over social media. Among consumers, 15% have made a payment over social media, and for those aged 16-24, it is 39%. The most used platforms are Facebook (76%), Instagram (23%), and Snapchat (11%).

39% of consumers aged 16-24 have made a payment

over social media

12 / 24

Welcome to the metaverse

Meanwhile, the metaverse has been trending globally and about

35% of the French consumers know what it is. This is a story to follow closely for merchants, who should be alert to the future opportunities and potential new revenues streams it enables. Indeed, FEVAD predicts a 76.9% annual growth rate in the AR/VR market (vCommerce) between 2019 and 2024, generating EUR 136.9 billion by 2024.

There appears to be cross-sector interest in the commercial opportunities of the metaverse already, with early movers including Insurance company Axa and supermarket chain Carrefour. Together, these organizations have announced they will join the metaverse by purchasing plots of land made by the video game company The Sandbox.

FEVAD predicts a 76.9% annual

growth rate in the AR/VR market

between 2019 and 2024, generating

EUR136.9

billion by 2024

13 / 24

The complexities of crypto

Approximately 2.1 million people (3.34% of the population) in France currently own cryptocurrency and more than 25,000 merchants now accept crypto as payment. The market also features crypto-based marketplaces, such as cocote, and several platforms offering gift cards in exchange for crypto.

The last couple of years has seen crypto regulation – and therefore complexity – intensify, starting with 2019’s PACTE Law. This law defined crypto firms as digital asset service providers and forced them to register with the Financial Markets Authority (AMF) to continue doing business in France or with French citizens. The Law allows professional specialized investment funds and private equity investment funds to invest in digital assets, subject to specific conditions and limits. But to prevent financial crimes, a mandatory KYC protocol and identity verification processes are in place.

2.1million

people in France currently

own cryptocurrency

14 / 24

Successful experiments with

central bank digital currency (CBDC)

In 2020, Banque de France launched nine experiments with private banks and tech firms to explore the issuance and use of a wholesale CBDC. Currently, seven out of the nine experiments are complete, and the results indicate a wholesale CBDC should indeed be considered, especially given it could complement the Eurosystem’s ongoing work on a digital euro for retail purposes.

15 / 24

Unpicking the Fraud Factor and Regulatory Environment

France has one of the highest fraud rates in Europe, which seems to be associated with limited visibility on compromised customer details, so fraudsters can use stolen cards or other details for longer before being detected. However, a shift to more secure payment methods in recent years has helped to reduce fraud, blocking many unauthorised transactions.

Buying online and picking up in-store is a safe and convenient payment journey for shoppers, and in France it has seen a decrease in fraud attempt rates over the past year by 0.4%, resulting in a 34% decrease in the average fraud chargeback. Mobile on the other hand has seen a slight increase in fraud attempts. The channel continues to grow in popularity, which brings with it the attention of the fraudsters.

France has seen a

34%

decrease in the average fraud

chargeback over the past year

16 / 24

Interestingly, eWallets experienced a significant decrease in fraud attempt rates by volume by 3.3%. This is potentially driven by secure authentication (e.g. biometric scan). Also, perhaps less surprisingly, credit cards and debit cards experienced a drop of nearly 6% in fraud attempts, potentially driven by high security authentication procedures/mandates in place, PSD2, and so on.

In the recent years, there has been a significant shift in customers’ behaviour moving to online shopping – and fraudsters have taken advantage of that. With a rapidly increasing volume on ecommerce transactions, it is even more pressing to have strong card authentication process and secure payment method to protect the customers from fraudulent activities such as identify theft or account take over.

A secure payment method can prevent the customers details from being compromised and used by fraudsters, and a strong card authentication process provides an extra layer of security to ensure the transaction is initiated by an authorised user.

It is also very important to understand what is normal versus unusual behaviour for each customer to block potentially fraudulent activities at very early stages. With large amount of data, knowing your customers can be a very complex task, but machine learning models can be extremely helpful analysing historical data for each customer to establish a “normal behaviour” and alerting unusual cases.

17 / 24

Another crucial element is to have the ability to identify transaction details that are associated to fraudulent activities – and using that information to identify fraudulent rings and block other fraudulent activities.

In terms of sector trends, with the uptick of ticketing and travel sales, fraud also increased, by 5% and 0.3% by volume, respectively. However, genuine transaction growth well outpaced the increase in fraud. Digital downloads continue to be attractive to fraudsters, seeing a 1.4% increase in fraud attempts. Retail however saw a slight dip in fraud, by 0.5%.

Substantial regulation governs payments in France and the first quarter of 2021 saw the country enter the final phase of PSD2 compliance, stipulating that merchants implement Strong Customer Authentication (SCA) processes by September 2021 to enhance online transaction security. Soon after, the latest data from CMSPIfor September 2021 suggests a European average failure rate of 29%, with France at 22%, compared to data from August 2021.

Credit cards and debit cards

experienced a drop of nearly

6%

in fraud attempts

18 / 24

Talking Payments: Interview with Christophe de Pompignan, the Global BNPL Director of Oney Bank

Christophe has built a strong international experience in FMCGs and Telecom and joined Oney Bank in 2008, where he was appointed Managing Director of Oney Bank in Italy, then Hungary and Portugal. In 2020, he was appointed Group BNPL Business Line Director, in charge of developing multichannel frictionless BNPL solutions for retail partners across Europe, fully embedded in all major Payments Services Providers solutions and ecommerce platforms.

What can you tell us regarding Oney’s reach?

How many users do you have and what is the typical user profile?

Oney invented the first split payment solution more than 14 years ago. We started with Pixmania on the web, and very quickly others were won over by our solutions, in all sectors and on all sales channels. Today, over 13,000 websites and stores use our split payment solutions to trade throughout Europe. Our solutions are universal and used by many businesses, from startups to retail giants, online, on the second-hand marketplace, in-store, for click-and-collect, and even in call centres. Each year, more than five million consumers use our solutions when shopping with our partners, whether for a purchase or a bigger project, while keeping their budget under control. In France, one in every three split payments is made using Oney. We are the leader in France, Italy, Romania, and Portugal, and no. 2 in Spain. Our aim is to become the leader in 80% of European countries.

19 / 24

Do you work directly with merchants or through PSPs?

Our ambition is to be able to respond to every retailer’s configuration and needs. To do this, we offer three types of integration. First, retailers can integrate our solutions directly using our international API. In a single connection, they can provide our solutions in the seven countries currently covered in Europe.

Secondly, over the past several years, we have developed an extensive network of service and payment providers, so that retailers can easily integrate our solutions through them (Adyen, Amadeus, Ingenico, Dalenys, Payline, and so on).

Finally, we want all retailers, even the smallest, to be able to access the same solutions. To achieve this, we collaborate with Payplug, a payment solutions specialist for VSEs and SMEs, to offer our solutions as part of the major CMS platforms on the market. With Payplug, we have also just signed a partnership with Prestashop, allowing their 136,000 online retailers to quickly and easily install our split payment module on their eCommerce site.

What sets Oney apart from the competition?

Our expertise built up over the past 14 years has given us a detailed understanding of consumer spending habits and therefore of risk management, which is absolutely critical when it comes to lending money to consumers, in all sectors and on all sales channels. This solid expertise means that we now offer one of the best acceptance rates on the market. We are also constantly working with our partners to improve their purchasing process and optimise their completion rate. These two services allow us to offer our retail partners the guarantee of maximum conversion.

The universality of our solutions is our second point of difference. We offer a full range of solutions, ranging from 30-day deferred payments to 60-month loans, including our flagship solution: payment in 3x 4x by bank card. These solutions can be used across all sectors, by all types of individuals or businesses, for any sales channel, including click-and-collect and call centres – channels that few competitors tend to address. The international scope of our business is also a key asset. We currently operate across 12 countries in Europe – and with more to come!

20 / 24

Thirdly, our connection with the BPCE group and our banking licence (which not all of our competitors have) ensure a high level of security for our partners and the guarantee of offering their customers ‘compliant’ and secure solutions.

Finally, we are renowned among retailers for the simplicity, quality, and proximity of our service and support. Oney is a bank that was created 38 years ago, by a retailer for retailers. Retail is in our blood.

What are the fees for using your payment product and who supports them?

This depends on the retailer’s trading strategy. In 38% of cases, split payments are offered free of charge by the retailer. For some, it is always free. For others, it is free during key commercial periods when the retailer uses it to further boost their sales. In other cases, the customer pays a fee, which remains very modest, given the service provided.

In France, for instance, for a payment in 3 instalments, the fee corresponds to 1.45% of the total amount, capped at EUR 15. For 4 instalments, it is 2.20% capped at EUR 30. So, when buying a washing machine for EUR 300 paid in 3 instalments, it will cost the customer the equivalent of a coffee per month. In all cases, the fees are clearly listed when signing up for this service, and there are no hidden fees. Oney, therefore, offers a clear and transparent solution. Deliberate payment defaults are rare for this type of payment, around 1%, and are subject to missed payment fees. Oney has a responsibility as a banker (security, transparency, and so on), and the customer also has one as a borrower. We believe that charging fees in the event of non-payment is a way to empower customers.

What are the typical credit acceptance rates you see with shoppers?

Our acceptance rate, depending on the activity sector and the retailer, is between 90 and 98% – almost the same as for cash payments! This performance guarantees our partners an optimal conversion rate and explains why 95% of users are satisfied with our solutions.

21 / 24

Can you elaborate on the performance of merchants offering your payment method in the payment process as regards conversion rates?

Oney’s partner retailers generally see their average basket increase by 20 to 70% – and sometimes more for some of them. There is a strong appetite among customers for this type of solution, and it creates value for brands. According to our studies, 72% of customers say that the opportunity to pay in instalments was the trigger for their purchase. In a relatively short time, split payment solutions have become a crucial means of growth for brands

In 2022 and beyond, what do you think will be key to staying ahead of the game? Can you offer us a glimpse into your plans for the near future?

Innovation has been at the heart of our leadership since our creation. As well as continuing our progress on the web and improving digital customer journeys, we are also determined to speed up the digitisation of in-store

payments. These are an important part of retail, and it is, therefore, crucial that we help brands offer their customers an experience that’s as simple, streamlined, and fast in store as it is online. Over the past several months, for example, we have been deploying processes that allow customers to pay in several instalments independently in a store – via terminals, for example – or with the assistance of a salesperson from the shop.

Finally, one of the strengths of our solution is the Oney Account. Each customer who uses Oney to pay in several instalments gets an account created in their name, which allows them to facilitate their next split payment. And because Oney has their information, it is quicker and easier to grant their request. We are also testing other technologies such as open banking to further improve the customer and retailer experience.

22 / 24

About Oney

Oney is a different, unique bank, born from commerce. We leverage our original positioning and our expertise developed over 35 years to design innovative payment solutions and financial services. Our statement: ‘Partner in the transformation of commerce, Oney gives everyone the power to improve their daily lives and consume better’.

As the creator of split payments 14 years ago, Oney is now the market leader in 4 European countries, with a fully digital and omnichannel offer that is unique on the market. Alongside our 600 merchant and e-merchant partners in nearly 13,000 physical and virtual points of sale, we support the projects of more than 7.8 million customers in Europe by offering them memorable shopping experiences in-store and online.

23 / 24

Want to learn more about capitalizing on the growth of eCommerce in France?

Talk to ACI’s eCommerce consultants today, to discover winning payments and fraud management strategies for the new normal of eCommerce.

Sources

- ACI data

- Autorité de la concurrence, Opinion 21-A-05 of 29 April 2021 on the sector of new technologies applied to payment activities - https://www.autoritedelaconcurrence.

fr/sites/default/files/attachments/2021-06/21-a-05_en.pdf

- International Trade Administration, France - Country Commercial Guide - https://www.trade.gov/country-commercial-guides/france-ecommerce

- JPMorgan, E-commerce Payments Trends Report: France - https://www.jpmorgan.com/merchant-services/insights/reports/france-2020

- Official website of the European Union - https://europa.eu/youreurope/citizens/consumers/shopping/guarantees-returns/index_en.htm

- Statista, eCommerce in France - https://www.statista.com/study/69516/ecommerce-in-france/

- Accenture - Shopping on Social Media Platforms Expected to Reach $1.2 Trillion Globally by 2025, New Accenture Study Finds - https://newsroom.accenture.com/

news/shopping-on-social-media-platforms-expected-to-reach-1-2-trillion-globally-by-2025-new-accenture-study-finds.htm

- Statista - Main social media platforms from which French consumers shop from in 2020 - https://www.statista.com/statistics/1190310/most-used-social-mediaplatforms-

for-shopping-france/

- FEVAD - Bienvenue dans la nouvelle ère du V-Commerce immersif - https://www.fevad.com/edito-bienvenue-dans-la-nouvelle-ere-du-v-commerce-immersif/

- Medium - The French face the metaverse - https://medium.com/@Karoievski/the-french-face-the-metaverse-e2ed649e9114

- Tech News Inc - Axa France has entered the Metaverse - https://technewsinc.com/axa-france-has-entered-the-metaverse/

- NFT Evening - French Supermarket Carrefour Enters the Metaverse - https://nftevening.com/french-supermarket-carrefour-enters-the-metaverse/

- Global Happenings - AND NOW FRANCE TV IS EMBARKING ON THE METAVERSE, BUT WHY?- https://globalhappenings.com/technology/100484.html

- Koinly - France Crypto Tax Guide 2022 - https://koinly.io/guides/crypto-tax-france/

- Euronews - France is grappling with how to tax cryptocurrencies such as Bitcoin - https://www.euronews.com/next/2021/10/14/france-is-grappling-with-how-totax-

cryptocurrencies-such-as-bitcoin

- Shufti Pro - Crypto Regulations 2021 – The Updated Compliance Regime in France - https://shuftipro.com/blog/crypto-regulations-2021-the-updated-complianceregime-

in-france/

- DLA Piper - France introduces an innovative legal framework for digital assets - https://www.dlapiper.com/en/us/insights/publications/2020/04/finance-andmarkets-

global-insight-issue-18/france-introduces-an-innovative-legal-framework-for-digital-assets/

- Finextra - Banque de France reports back on wholesale CBDC programme - https://www.finextra.com/newsarticle/39173/banque-de-france-reports-back-onwholesale-

cbdc-programme

- Banque de France - Wholesale Central Bank Digital Currency Experiments with The Banque De France - https://www.banque-france.fr/sites/default/files/

media/2021/11/09/rapport_mnbc_0.pdf

- Cocote - https://fr.cocote.com/crypto-monnaies#marketplace-bons-d-achat-payables-en-crypto-bitcoin-ethereum

- Payments Cards & Mobile - France and cryptocurrency: from laggard to vanguard - https://www.paymentscardsandmobile.com/france-and-cryptocurrency-fromlaggard-

to-vanguard/

- GLOBAL DATA, France Cards and Payments: Opportunities and Risks to 2025

- GLOBAL DATA, Macroeconomic Outlook Report: France

- Statista, Smartphone penetration in France in 2020, by age group - https://www.statista.com/statistics/408427/smartphone-penetration-in-france-by-age-group/

24 / 24